According to research by the business information provider, Creditsafe, companies led by women were 20% less likely to fail than those led by men in 2022.

This finding is significant because it highlights the positive impact that gender diversity can have on business performance.

The underrepresentation of women in senior leadership roles has been a long-standing issue in the business world. Although there has been some progress in recent years, women still face many challenges, including unequal pay and lack of access to funding and resources.

However, studies show that companies with more diverse leadership teams tend to perform better, and companies run by women in particular have been found to be more successful.

The purpose of this article is to explore the reasons why companies run by women are less likely to go bust than those run by men. We will discuss the empirical evidence supporting this claim, provide case studies of successful women-led companies, and address the challenges that women face when starting and running their businesses.

We hope that this article will highlight the importance of gender diversity in the workplace and encourage organisations to prioritise women’s leadership in their decision-making processes.

The Importance of Gender Diversity in the Workplace: A Brief Background

The current state of gender diversity in the workplace is far from ideal. Companies led by women are more likely to thrive and succeed, as research has shown that they are less likely to go bankrupt than those led by men.

Although there has been some progress in recent years, women are still underrepresented in senior leadership roles in most industries. According to a report by the Women in the Workplace study conducted by LeanIn.Org and McKinsey & Company, women make up only 38% of all managers and 22% of senior managers.

Furthermore, women of colour are even more underrepresented in leadership positions. This lack of representation not only creates an unequal workplace but also leads to a lack of diverse perspectives in decision-making.

There are several reasons why women are underrepresented in senior leadership roles. One of the main reasons is the existence of gender bias, which often results in women being overlooked for leadership positions. Studies show that women are often perceived as less competent and less authoritative than men, which affects their chances of being promoted to leadership roles. Additionally, women often face barriers to career advancement, such as unequal pay and lack of access to networking opportunities and mentorship.

Gender diversity in leadership has been shown to have a positive impact on business performance. Research shows that companies with diverse leadership teams tend to be more innovative and have better financial performance. Furthermore, companies with women in leadership positions tend to have better employee engagement and retention rates. This is because women leaders tend to create more inclusive work environments and prioritize employee well-being. Therefore, promoting gender diversity in the workplace is not only a matter of social justice but also makes good business sense.

Empirical Evidence Supporting Women-led Companies

Recent studies have shown that companies run by women tend to outperform those led by men. A 2019 study by the Peterson Institute for International Economics found that companies with at least 30% of women in leadership positions had a net profit margin that was 6% higher than companies with no women in leadership positions.

Furthermore, a study by the financial services firm, Fidelity International, found that companies with more diverse boards had better stock price performance than those with less diverse boards. These findings suggest that gender diversity in leadership has a positive impact on business performance.

One of the factors contributing to the success of women-led companies is better financial management. Studies show that women tend to be more risk-averse than men, which means that they are less likely to take on excessive debt or engage in risky financial practices. Additionally, women tend to be more focused on long-term financial planning, which can lead to better financial performance over time.

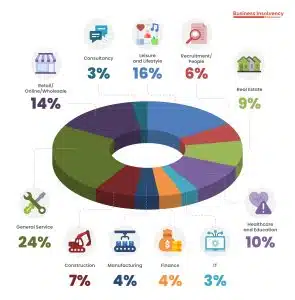

Recent research has shed light on the insolvency rates of male-owned businesses versus those run by females. The study, which analyzed companies with a board comprising at least 75% men or women, found that male-dominated businesses had a higher rate of insolvency between October 2021 and 2022. In fact, the insolvency rate for male-led companies was 0.84%, which was 42% higher than the rate for female-led companies at 0.59%.

The study also revealed that single-director companies had a higher overall insolvency rate than companies with multiple directors. Interestingly, the data showed that male-owned companies were more likely to become insolvent, with an insolvency rate of 1.08%, compared to female-led companies at 0.77% (a difference of 30%). These findings demonstrate that gender diversity in leadership is a key factor in business success, and that male-led businesses may benefit from adopting more inclusive and collaborative leadership practices.

Women-led companies also tend to be more resilient in the face of economic downturns, as they are better at cutting costs and managing cash flow during difficult times. Finally, women tend to have better team dynamics, as they are more collaborative and inclusive in their leadership style. This can lead to better employee engagement and retention, which is crucial for business success.

Post Covid insolvency world

While the COVID-19 pandemic has had a significant impact on overall insolvency rates, it appears that the gender difference in insolvency rates was already in effect before the pandemic hit. In fact, a 2018 study found that male-dominated businesses were 70% more likely to become insolvent than female-dominated firms, indicating that the gender disparity in business success was already present.

Interestingly, the failure rate of female-owned businesses has increased threefold since the pandemic began, rising from 0.20% to 0.59%. However, this increase has been less steep for male-owned businesses, which saw their failure rate rise from 0.34% to 0.84%. Despite these trends, the latest research reveals that the insolvency rate is still over 40% higher in male-led companies than in female-led ones.

Another important takeaway from the study is that four times as many companies are run by majority men than women, which further underscores the importance of gender diversity in business leadership. Although the overall insolvency rate in both groups has increased by a factor of 200%, it is crucial to note that gender diversity in leadership can play a crucial role in mitigating this risk and improving business performance.

Case Studies

Case Study 1:

BrewDog BrewDog is a Scottish craft beer company that was founded in 2007 by James Watt and Martin Dickie. Although the company was initially led by both men, in 2017, they appointed Tanisha Robinson as the managing director of their US operations. Under her leadership, the company expanded its footprint in the US, opening several new bars and launching its beer in new states.

In addition, Robinson implemented a number of initiatives to improve employee engagement and diversity, including offering more flexible working arrangements and creating a diversity and inclusion committee. These strategies have helped BrewDog to achieve significant growth, with the company reporting a revenue increase of 50% in 2021.

Case Study 2:

The Cambridge Satchel Company The Cambridge Satchel Company is a British fashion brand that was founded by Julie Deane in 2008. Deane started the company from her kitchen table with just £600, and it has since grown to become a global brand with a turnover of over £13 million.

One of the key strategies that Deane implemented to achieve this success was to focus on creating high-quality, timeless products that would stand the test of time. She also prioritised building strong relationships with customers, leveraging social media and other digital channels to connect with them on a personal level. In addition, Deane has been a strong advocate for entrepreneurship and has actively supported other female-led businesses through mentorship and funding.

Case Study 3:

Innocent Drinks Innocent Drinks is a UK-based beverage company that was founded in 1999 by Richard Reed, Adam Balon, and Jon Wright. Although the company was founded by three men, in 2018, it appointed Mariam Khotun as its first-ever chief financial officer. Under Khotun’s leadership, the company has implemented a number of initiatives to improve sustainability, including sourcing ingredients from ethical and sustainable suppliers and reducing packaging waste.

In addition, Khotun has prioritised employee wellbeing, implementing policies such as unlimited paid time off and flexible working arrangements. These strategies have helped Innocent Drinks to become a leader in the sustainable beverage industry, with the company reporting a revenue increase of 8.5% in 2021.

Strategies for Overcoming Challenges Faced by Women in Business

Starting and running a business is a challenging task for anyone, but women entrepreneurs often face unique challenges that can hinder their success. One of the biggest challenges that women face is accessing funding and investment. Studies have shown that women-led businesses receive significantly less funding than male-led businesses, making it difficult for women entrepreneurs to scale their businesses.

Additionally, women often face biases and discrimination in the workplace, which can limit their opportunities for growth and advancement. This can include a lack of access to mentorship and networking opportunities, as well as gender-based barriers to accessing certain industries.

Despite these challenges, there are a number of strategies that women entrepreneurs can implement to overcome these obstacles and achieve success. One of the most important strategies is to build a strong support network of mentors and advisors who can provide guidance and support.

This can include seeking out female-led business organisations and networking groups, as well as working with experienced mentors who can provide advice on everything from funding and investment to marketing and sales strategies.

Women entrepreneurs should prioritise building their skills and knowledge through training and education, as this can help to build confidence and improve their chances of success.

Finally, women entrepreneurs can take steps to challenge gender biases and discrimination in the workplace. This can include speaking out about gender-based inequalities and advocating for policies and initiatives that promote gender equality in the workplace.

By working together to address these challenges and implement effective strategies, women entrepreneurs can overcome the obstacles they face and achieve their full potential in the world of business.

Reasons why female led businesses are less likely to go insolvent

There are several reasons why companies run by women are less likely to go bust than those led by men. Some of the key factors include:

- Better financial management: Research has shown that women are more risk-averse than men when it comes to managing finances, which can lead to more cautious decision-making and better financial management. This can help companies to avoid taking on excessive debt and to maintain healthy cash flow, reducing the risk of insolvency.

- Resilience: Women-led businesses are often more resilient than their male-led counterparts, with a greater ability to weather economic downturns and navigate periods of uncertainty. This may be due to a range of factors, including a more collaborative and supportive leadership style, a focus on sustainability and long-term growth, and a willingness to adapt to changing market conditions.

- Better team dynamics: Women are often better at building and maintaining strong teams, with a focus on collaboration, communication, and mutual support. This can lead to a more positive work culture, better employee engagement and retention, and ultimately, better business performance.

Overall, these factors highlight the importance of gender diversity in business leadership, and the need for organisations to prioritise the recruitment and retention of female talent in order to drive sustainable growth and success.

Do male-led businesses take on more risk?

Research has consistently shown that women-led businesses are less likely to take on excessive risk, particularly in the early stages of business development. This can be attributed to a number of factors, including a tendency for female entrepreneurs to approach business decision-making with a more cautious and conservative mindset, and a greater emphasis on thorough research and planning before taking the plunge.

Moreover, studies suggest that women are more likely to focus on building strong, sustainable business models that prioritise long-term growth and stability over short-term gains. This approach can be particularly beneficial during times of economic instability, where businesses that have taken on too much risk may struggle to survive.

Ultimately, while taking calculated risks is an important part of building a successful business, research indicates that a more measured approach to risk-taking, as demonstrated by many women-led businesses, may lead to more sustainable growth and success in the long run.

Male-led businesses in the UK are significantly more likely to enter insolvency than their female-led counterparts. In fact, the insolvency rate for male-led companies is over 40% higher than that of female-led companies. This statistic is particularly striking given that four times as many companies are run by majority men than women.

While the overall insolvency rate in both groups has increased by a factor of 200% since 2018, female-led businesses still maintain a lower insolvency rate than male-led businesses. These findings suggest that gender diversity in business leadership may be a critical factor in reducing the risk of business failure and promoting long-term success.

Frequently asked questions

The research indicates that companies run by women are less likely to go bust than those led by men. A recent study found that male-owned businesses were over 40% more likely to go into insolvency between October 2021-22 than those run by females. The study looked at the insolvency rate of companies with a 75%+ male or female board and showed that male-dominated companies went bust at a rate of 0.84%, versus 0.59% for majority-female companies. This means that companies were 42% more likely to become insolvent if their boards were male-dominated.

Women face a number of challenges when starting and running their businesses, including systemic bias and discrimination, a lack of access to funding and resources, and a lack of representation in senior leadership positions. This can make it difficult for women to gain access to the resources and support they need to succeed, and can hinder their ability to scale and grow their businesses.

There are a number of strategies that can be implemented to overcome the challenges faced by women in business. These include implementing policies to address bias and discrimination, providing mentorship and networking opportunities, ensuring that women have access to funding and resources, and promoting greater representation of women in senior leadership positions. By taking these steps, organizations can help to create a more equitable and inclusive environment for women in business, and can benefit from the unique perspectives and insights that women bring to the table. What does the research suggest about the likelihood of companies led by women going bust compared to those led by men?

What are some of the challenges that women face when starting and running their businesses?

What strategies can be implemented to overcome these challenges?

About the Study

Research used Creditsafe’s database of four million companies in the UK. We have used two lots of four data sets were collected.

Data Set 1 includes:

- A count of all active companies with just two men on the board or a majority of 75% of the board that have been actively trading in the last 12 months [579,832].

- A count of boards containing just two women or a majority of 75% of the board that have been actively trading in the last 12 months [67,047].

- A count of all companies that went into administration or liquidation in male-run businesses as above [4,870 companies went into liquidation, compulsory liquidation (winding up order) administration or appointment of liquidators from October 2021].

- A count of all companies that went into administrator or liquidation in female-run businesses as above [397 companies went into liquidation, compulsory liquidation (winding up order) administration or appointment of liquidators from October 2021].

- Businesses without a gender bias of at least 75% were excluded.

Data Set 2

- There are 1,776,275 active companies with just one man on the board that have been actively trading in the last 12 months.

- There are 539,861 companies containing just one woman on the board that have been actively trading in the last 12 months.

- Among male-run businesses, 19,262 companies went into liquidation, compulsory liquidation (winding up order), administration, or appointment of liquidators from October 2021.

- Among female-run businesses, 4,196 companies went into liquidation, compulsory liquidation (winding up order), administration, or appointment of liquidators from October 2021.

The study excluded single-person directors and businesses with less than a 75% gender bias. The rationale behind this exclusion was that single director companies primarily consist of personal service companies, which are not small businesses requiring complex financial controls and employment of people, but rather serve as a way of paying less tax.

Moreover, certain rule changes in the last year have led to a significant rise in insolvency rates of personal service companies to do with allowable expenses.

Research in America has investigated whether males or females are better at running businesses (https://journals.aom.org/doi/abs/10.5465/256305).

The researchers found no discernible difference. However, research done after the financial crisis showed that female-run banks were less likely to go bust (https://link.springer.com/article/10.1007/s10551-014-2288-3).

Further studies are needed to determine whether gender influences business failures. Since many business failures are caused by not taking action early enough or seeking advice, the old cliché that men don’t follow instructions or ask for help in many aspects of their lives may hold true in their roles as Directors of companies.

Conclusion

In conclusion, the evidence is clear that companies run by women are less likely to go bust than those led by men. This article has discussed the current state of gender diversity in the workplace, the reasons behind the under-representation of women in senior leadership roles, and the success factors of women-led companies.

The findings have important implications for organizations, highlighting the need to prioritize gender diversity in their leadership teams. By doing so, companies can benefit from better financial management, greater resilience, and stronger team dynamics, all of which contribute to long-term success.

Therefore, we call on organizations to take concrete steps to increase gender diversity in their leadership teams, such as addressing bias and discrimination, providing mentorship and networking opportunities, and ensuring that women have access to the resources they need to succeed. By prioritising gender diversity, companies can improve their own performance and contribute to a more equitable and inclusive society for all.

With over three decades of experience in the business and turnaround sector, Steve Jones is one of the founders of Business Insolvency Helpline. With specialist knowledge of Insolvency, Liquidations, Administration, Pre-packs, CVA, MVL, Restructuring Advice and Company investment.